The pursuit of higher education can be a transformative experience, but it often comes with significant financial burdens. Tuition, fees, housing, and textbooks can quickly add up, making it essential for students and their families to explore various financial aid options. Fortunately, numerous resources are available to help alleviate these costs and make college more accessible. This article delves into the different types of financial aid options available to college students, the application process, and tips for maximizing your financial support.

Understanding Financial Aid

Financial aid is any form of funding that helps students cover the cost of their education. It can come from various sources, including the federal government, state governments, colleges and universities, and private organizations. Financial aid is typically divided into three main categories: grants, scholarships, and loans.

- Grants: Grants are a form of financial aid that does not need to be repaid. They are often based on financial need and are awarded to students who demonstrate a lack of resources to pay for their education. The most common federal grant is the Pell Grant, which is available to undergraduate students. Eligibility for the Pell Grant is determined through the Free Application for Federal Student Aid (FAFSA). Many states and colleges also offer their own grant programs, which may have different eligibility criteria.

- Scholarships: Scholarships are another type of financial aid that does not require repayment. They can be awarded based on various criteria, including academic achievement, athletic ability, artistic talent, or demographic factors. Scholarships can come from multiple sources, such as private organizations, corporations, community foundations, and educational institutions. Students should actively seek out scholarship opportunities, as they can significantly reduce the cost of attending college.

- Loans: Loans are a form of financial aid that must be repaid, often with interest. Federal student loans generally offer lower interest rates and more favorable repayment terms compared to private loans. Two common types of federal loans are Direct Subsidized Loans and Direct Unsubsidized Loans. Subsidized loans are based on financial need, while unsubsidized loans are available to all students regardless of need. It’s essential to understand the terms and conditions of any loan before borrowing to ensure that you can manage repayment after graduation.

The Financial Aid Application Process

To access federal financial aid, students must complete the FAFSA. The FAFSA is a comprehensive form that collects information about a student's financial situation and determines their eligibility for various aid programs. Here’s a step-by-step guide to navigating the application process:

- Gather Required Documents: Before starting the FAFSA, gather necessary documents such as your Social Security number, driver’s license, tax returns, and financial records for yourself and your family. If you are a dependent student, you will also need your parents' financial information.

- Create an FSA ID: An FSA ID is a username and password that you’ll use to log in to the FAFSA website. This ID allows you to electronically sign your FAFSA and access your financial aid information.

- Complete the FAFSA: Visit the official FAFSA website and fill out the online form. Be sure to provide accurate information, as discrepancies can delay your financial aid processing. The FAFSA opens each year on October 1, and it’s advisable to complete it as early as possible to maximize your aid eligibility.

- Review Your Student Aid Report (SAR): After submitting your FAFSA, you will receive a Student Aid Report, which summarizes the information you provided. Review it carefully for accuracy and make any necessary corrections.

- Receive Financial Aid Offers: Once your FAFSA is processed, colleges will send you financial aid offers based on your eligibility. These offers may include a combination of grants, scholarships, and loans.

- Accept or Decline Aid: Review your financial aid offers and decide which aid packages to accept. Keep in mind that you are not required to accept loans if you feel you can manage without them.

Types of Financial Aid Programs

In addition to federal aid, students should explore various financial aid programs offered by state governments, private organizations, and educational institutions.

- State Financial Aid Programs: Many states have their own financial aid programs designed to assist residents pursuing higher education. These programs can include grants, scholarships, and loan forgiveness programs. To qualify, students often need to be residents of the state and may need to apply separately from the FAFSA. Research your state’s financial aid resources to ensure you’re not missing out on potential funding.

- Institutional Financial Aid: Colleges and universities often provide financial aid packages to students based on their financial need or academic merit. Institutional aid can come in the form of grants, scholarships, or work-study programs. Some schools may have unique scholarships or programs tailored to specific majors, extracurricular activities, or demographic groups. Contact your school’s financial aid office for detailed information about available institutional aid.

- Private Scholarships: Numerous private organizations and foundations offer scholarships to students. These scholarships may have specific eligibility criteria, such as being a member of a particular group, demonstrating leadership skills, or pursuing a specific field of study. Websites like Fastweb, Cappex, and College Board’s Scholarship Search can help students find and apply for private scholarships.

Tips for Maximizing Financial Aid

Navigating the world of financial aid can be complex, but there are several strategies students can use to maximize their support:

- Apply Early: Completing the FAFSA as early as possible increases your chances of receiving the most financial aid. Some states and colleges have limited funds, and aid is often awarded on a first-come, first-served basis.

- Keep Accurate Records: Maintain organized financial records and documentation related to your FAFSA and other financial aid applications. This will make the process smoother if you need to make corrections or appeal decisions.

- Follow Up: After submitting your FAFSA and other applications, follow up with the financial aid office to ensure everything is processed correctly. Don’t hesitate to ask questions if you’re uncertain about any aspect of your aid package.

- Consider Work-Study Programs: If offered a work-study position, consider accepting it. Work-study allows you to earn money while attending school, helping to cover living expenses without accruing debt.

- Reevaluate Annually: Financial situations can change, and so can financial aid eligibility. Make it a habit to reevaluate your financial aid options each year, as you may qualify for different programs or increased support as you progress in your education.

- Appeal for More Aid: If your financial situation changes significantly after submitting your FAFSA, contact your school’s financial aid office. They may be able to reassess your application and offer additional aid based on your circumstances.

- Explore Loan Forgiveness Programs: Certain professions, such as teaching or public service, may offer loan forgiveness programs for graduates. Research opportunities that align with your career goals and consider how they might impact your financial planning.

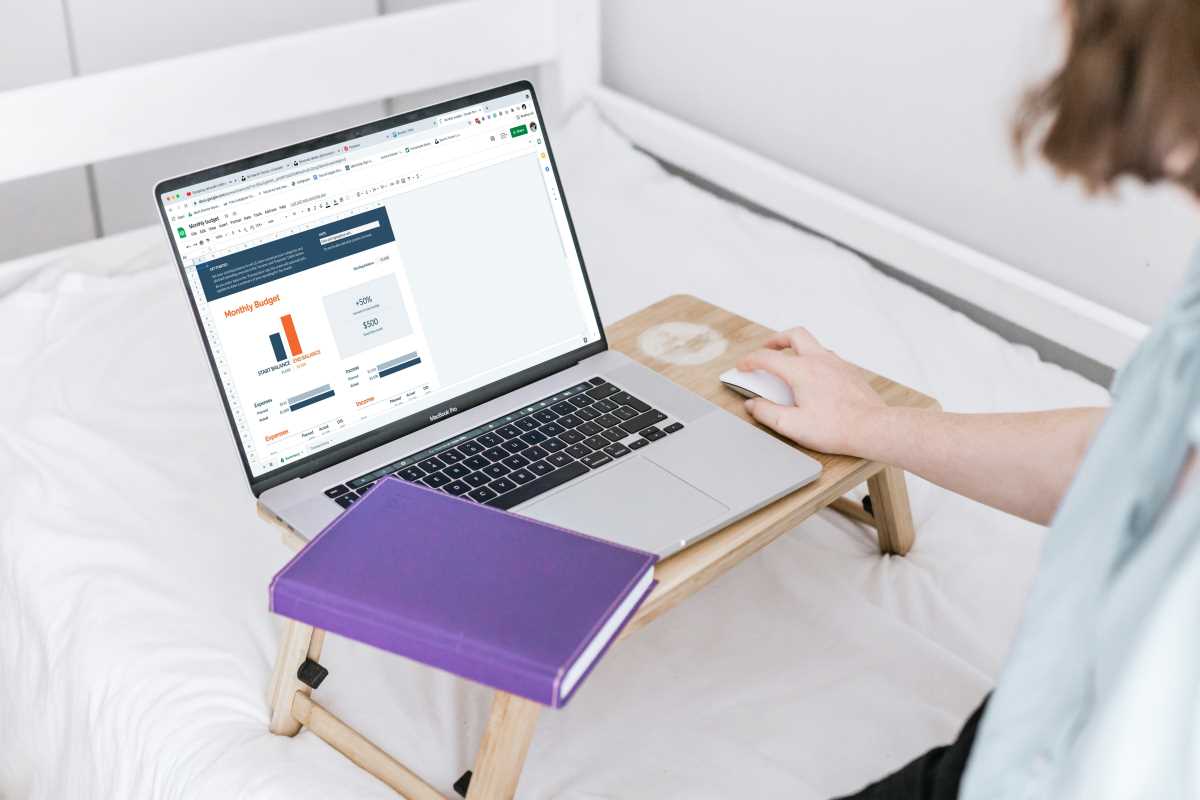

Understanding Financial Literacy

As students navigate their financial aid options, it’s essential to develop financial literacy skills. Understanding how to manage finances, budget for expenses, and make informed decisions about loans and repayments is crucial for long-term financial well-being. Many colleges offer workshops and resources aimed at improving financial literacy. Take advantage of these opportunities to build your knowledge and confidence in managing your finances.

The Importance of Communication

Finally, open communication among family members about finances is essential. Discussing financial situations, goals, and expectations can help students and their families work together to make informed decisions regarding college funding. Encourage family members to share their insights and experiences, which can lead to better understanding and collaboration when navigating financial aid options.